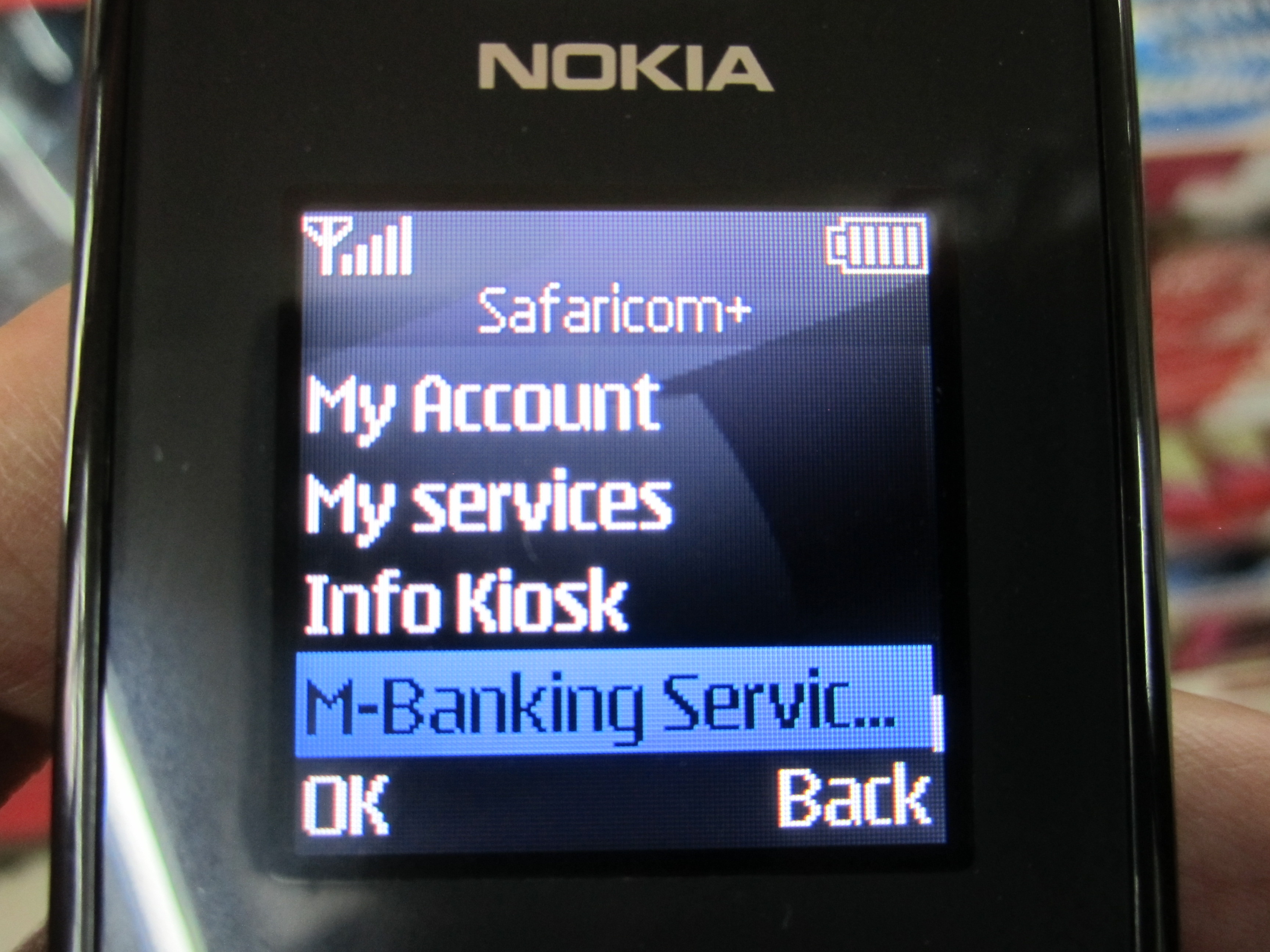

class: center, middle, inverse, title-slide # DSBA 20598 – FinTech and Blockchains ## Lecture 3: Payment Technology // <br> Foundations of Blockchain ### Prof. Silvio Petriconi ### Department of Finance, Bocconi University ### 2019-09-19 (updated: 2019-09-29) --- class: inverse, left background-image:url("img/cash-register-78741_1920.jpg") background-position: left background-size: cover #Payment Technology Evolving -- ### | Origins ### | Infrastructure ### | Retail instruments ### | Blockchain: foundations --- # Payment Technology Until very recently, payment technology has been playing a stepkind-like role in the world of finance. It was considered the bureaucratic part of financial business, comprising of the purely mechanical settling of payments, with little upside potential. Relatively few finance professionals were interested in it. This has changed dramatically. First, digital payment technology is having unmatched success in emerging markets because it allows buyers and mechants to ameliorate severe frictions and risks involved with the use of actual cash, for example theft or geographical distance to the next bank. Second, data scientists have woken up to the idea of tapping payment data. There is only one kind of data that records virtually every real transaction in this economy: payment data. With recent progress in data science, the potential to tap these data seems unlimited. Finally, blockchain has put the idea of payment processing upside down, even though the most fruitful application of blockchain might not even be payments. --- class:inverse, middle, center background-image:url("img/creditlyonnaise_vault.jpg") background-size:cover # Origins of Payment Technology .left[.footnote[.tiny[Image by <a href="//commons.wikimedia.org/wiki/User:Rdavout" title="User:Rdavout">Renaud d'Avout</a> - <span class="int-own-work" lang="en">His hown work</span>,<br> <a href="https://creativecommons.org/licenses/by-sa/3.0" title="Creative Commons Attribution-Share Alike 3.0">CC BY-SA 3.0</a>, <a href="https://commons.wikimedia.org/w/index.php?curid=16817905">Link</a>]]] --- #Cash .left-column[  Denarius coin of Marcus Aurelius. .small[Credit: [Rasiel](https://en.wikipedia.org/wiki/User:Rasiel) at English Wikipedia. CC-BY-SA 3.0] ] .right-column[ Cash is the most immediate way to pay for goods or services. Across cultures, the type of objects that could play a money-like role has been quite different, ranging from commodities like metals or [seashells](https://en.wikipedia.org/wiki/Shell_money) to [fiat money](https://en.wikipedia.org/wiki/Fiat_money). Common properties of physical objects that have played the role of money are: * limited supply * durable, not easily damaged * difficult to forge * easy to transport A particular problem that was common among all precious metal coins was that metal bits were often scraped off the coin before using it to pay. Payees often consulted experts for cash, bankers and goldsmiths, before accepting a coin. ] --- # Settling distant payments Cash is fine for settling payments right in the moment. It was and remains terrible for settling payments at a geographically distant place: the risks of loss grew with distance, the probability of acceptance decline with it. You can find amazing castles and fortresses along all the big historical trade routes in Europe (e.g. Rhine valley, Brenner route through Alto Adige). Imagine you had travelled along such route carrying cash to pay someone. How much of your cash would have been taken from you on the road by the castles' inhabitants? We can suspect that the mere problems of cash management and payment over distance led to the emergence of "warehouse-like" intermediaries that were predecessors of modern banks: * accepting deposits of coins for storage * issuing deposit receipts that were payable in "good money", i.e. intact coins * netting of claims versus other banks, thus enabling payments to payees in other cities without the transport of physical cash. --- # Bank deposits as money The words "I pay you" and "I send the money to your bank account" seem synonyms for most people. They are clearly not the same. If I pay you, you receive __currency__. If I wire money to your account, you receive a __private liability__ of a bank: a deposit. We can see that bank deposits have acquired equivalent function of money, and that deposits are transferred easily between many banks and depositors. For this to work, banks need reliable channels of __settling__ claims against each other in definitive curency. We will now look at what these channels are today. --- class: inverse, center, middle background-size:cover background-image:url("img/nyfed-vault.jpg") # Payments Infrastructure: ## Large Value Payment Systems --- # Large value payment systems Most central banks as well as several private clearinghouses operate dedicated large value payment systems (LVPS) through which banks make and settle payments to each other. Settlement refers to the actual payment of an obligation in central bank money. Large value payment systems settle extremely large volumes of transactions. For example, the European payment system [TARGET2](https://www.ecb.europa.eu/paym/target/target2/html/index.en.html) settles every week values in excess of _annual_ Eurozone GDP. A similar system in the United States is [Fedwire](https://www.frbservices.org/financial-services/wires/index.html). Depending on their mode of operation, one can distinguish between two different "flavors" of LVPS systems, even though in practice most systems today combine hybrid elements from both types: * __deferred net settlement__ systems settle payments by accumulating payments for a certain period of time and subsequently netting all positions. * __real time gross settlement__ (RTGS) systems instantly transfer the gross amount of funds for every transaction to the payee. Today most central bank operated payment systems, e.g. [Fedwire](https://www.frbservices.org/financial-services/wires/index.html) (USA), [TARGET2](https://www.ecb.europa.eu/paym/target/target2/html/index.en.html) (Eurozone), and [CHAPS](https://www.bankofengland.co.uk/-/media/boe/files/payments/rtgs-and-chaps-service-description-december-2018) (United Kingdom), are RTGS systems. --- # Deferred net settlement systems Deferred net settlement has unique advantages in terms of liquidity sparing operations: consider the following graph of transactions that need to be settled between banks A, B, C and D: .pull-left[  ] .pull-right[ As we can see, the payments are larger in gross terms than in net, i.e. after offsetting payments in opposite direction have been taken into consideration. As deferred net settlement systems settle only at several points during the day, it's quite likely that a lot of offsetting payments accumulate and can be netted out by the time settlement takes place. In this way, deferred net settlement systems have much lower liquidity requirements than RTGS systems (to settle the same claims). ] ??? ```graphviz digraph L0 { size = "8,8"; ordering=out; node [shape = box]; nA [label="Bank A"]; nB [label="Bank B"]; nC [label="Bank C"]; nD [label="Bank D"]; nA -> {nC} [label="100"] nA -> {nB} [label="85"] nB -> {nA} [label="140"] nB ->nD [label = "10"] nC -> {nD} [label="43"] nC -> {nB} [label="55"] nD -> {nA} [label="58"] } ``` --- # Deferred net settlement systems Technically, most deferred net settlement systems perform the multilateral netting by introducing a central counterparty against which all the claims are held. Taking the previous example of the payment graph to a deferred net settlement system would result in the following net obligation structure: .pull-left[  ] .pull-right[ As you can see, the net payments are little compared to the gross amounts. The downside of deferred net settlement systems is that they create credit risk: what if in the evening at netting, it is found that bank B doesn't have 10 (and disappears in a bankruptcy cloud)? Who gets what? Which payments are considered settled? ] ??? Code to generate graph: ```graphviz digraph L0 { size = "8,8"; ordering=out; node [shape = box]; nA [label="Bank A"]; nB [label="Bank B"]; nC [label="Bank C"]; nD [label="Bank D"]; ccp [label="System" shape=circle style = "filled" fillcolor="green"] ccp-> nA [label="13"] nB->ccp [label="10"] ccp->nC [label="2"] nD->ccp [label= "5"] } ``` --- # RTGS Systems RTGS systems settle in real time, so they don't create any credit risk. This enables RTGS to deliver instant _payment finality_: once inserted, payments are irrevocably executed, and the payee can can immediately use the proceeds for any purpose. However, RTGS systems have much higher liquidity needs than deferred net settlement systems. Even worse, they can suffer from _liquidity starvation_ and freeze up. This would happen if several of the participants don't have sufficient liquidity for gross payments, and offsetting payments are delayed for some reason. This has been a major concern in the crisis. To see the problem, in our previous example check what would happen if bank A's payments got delayed for some reason, and no other bank had more than 50 units of funds to start with (which is already more than four times the net obligation)! --- # Resources on payment systems .pull-left[[ ](https://www.ecb.europa.eu/pub/pdf/other/paymentsystem201009en.pdf) ] .pull-right[If you ever find yourself in need of understanding more about the payment system, an excellent resource is the [ECB Bluebook](https://www.ecb.europa.eu/pub/pdf/other/paymentsystem201009en.pdf) on the payment system. It's somewhat dated but still explains the fundamentals extremely well (and the payments world hasn't changed that much since it was written). With over 250 pages, it's not a quick read though.] --- # Innovation front 1: Instant payments One problem of traditional LVPS systems is that payments are only accepted during certain hours of the day, making 24x7 instant payments practically impossible. This stands in sharp contrast with growing customer demand for instant payments. A very recent development are dedicated extensions of existing payment systems which allow 24x7 real time settlement of payments. In Europe, [RT1](https://www.ebaclearing.eu/services/instant-payments/introduction/) by EBA Clearing (since Nov 2017), and [TIPS](https://www.ecb.europa.eu/paym/target/tips/html/index.en.html) which runs since Nov 2018 as an extension of TARGET2 are two new exciting possibilities for banks to settle payments in real time around the clock. Despite the possibilities offered by these new infrastructures, very few banks are currently offering instant payment services. It is not trivial to integrate 24x7 payment operations with existing risk and IT frameworks, especially given that many of them are built around the assumption of fixed daily cutoff times. --- #Innovation front 2: Cross-border payments Cross border retail payments are just a nightmare, as the different currencies, jurisdictions and time zones add many more complications. Traditionally, cross-border retail payments are made through _corresponding banks_ in the destination country. This means that, for example, an Italian bank deposits a large amount of foreign currency at a foreign (e.g. U.S.) institution under an agreement that allows it to use this account for the foreign currency leg of foreign exchange transactions. The details are quite messy, see e.g. this excellent [report by the BIS](https://www.bis.org/cpmi/publ/d173.pdf), which also notes that >Users’ experiences often fail to meet their expectations, particularly for certain use cases. Transparency, speed and costs are the key dimensions of shortfall. --- #Innovation front 2: Cross-border payments It would be unfair to blame the poor customer experience with cross-border payments just on banks Much of the problem lies in the complexity of the numerous risk mitigation measures that are in place due to the international nature of the transaction, and regulation makes it hard for banks to innovate in this respect. Example: [Herstatt risk](https://en.wikipedia.org/wiki/Settlement_risk) is mitigated by using [CLS Bank's](https://www.cls-group.com/products/settlement/clssettlement/how-it-works/) payment-versus-payment mechanism, but this may add further delay or cost. In summary, there clearly is a lot of scope for simplification of cross border payment procedures, which has high relevance in an increasingly globalized world. Banks rarely find themselves in a good position to drive forward such innovation. We will certainly see a lot of innovation in this area over the coming years as FinTech firms like [Revolut](https://www.revolut.com) and [TransferWise](https://www.transferwise.com) are heavily investing in this field. --- #Innovation front 3: Blockchain for RTGS? RTGS systems are notoriously expensive to operate: redundancy and extensive failover scenarios, dedicated hardware and software, and expensive required specialist skills all drive up their cost. Catastrophic outages must be avoided to the maximum extent possible (the Bank of England can [tell a story](https://www.bankofengland.co.uk/-/media/boe/files/report/2015/independent-review-of-rtgs-outage-on-20-october-2014-boes-response) about this. They were unable to settle GBP 290 billion of payments some day in 2014 when their system [went down](https://www.theguardian.com/business/2015/mar/25/bank-of-england-payment-system-collapsed-due-to-design-fault).) Blockchain by design allows for a more decentralized handling of transactions than traditional settlement systems and thus potentially have better failover behavior, plus they require cheaper hardware and less complex software. For this reason, financial market infrastructure operators are increasingly looking into the use of (permissioned) blockchains to eventually replace existing RTGS settlement systems. --- class: inverse, middle, center background-image:url("img/money-256281_1920.jpg") background-size: cover # Retail Payment Instruments: ## Everywhere you want to be? --- # Credit Cards Credit cards allow you to make purchases on credit by merely communicating your credit card number to a merchant. This can even be done by phone. The merchant the bills your credit card company, which has provided you with a credit line from which it pays for your purchases. Whilst very common in the U.S., credit cards have had a very low market share in Europe and Asia for very long, but growing internet adoption has tilted the numbers dramatically in their favor. One aspect that makes credit cards particularly useful as payment instruments in online transactions is that every credit card transaction is protected by a dispute process: if you're not receiving what you paid for, or if you were charged without authorization, you can raise a dispute with your credit card company. The company will settle the dispute after hearing the merchant (and seeing evidence, if needed). This dispute element is a core element in almost all payment instruments that ever became relevant for online payments, e.g. PayPal. --- # How credit card transactions work Credit card transactions are relatively complicated. First, the credit card transaction is __authorized__ by submitting the transaction request to the (merchant's) _acquiring bank_, which forwards the request to the card issuer's bank. The response arrives in real time. Roughly speaking, there is a distinction between * _card present transactions_, where the card was physically presented * _card not present transactions_, e.g. internet orders, subscription billing etc. Merchants are charged higher fees for the latter because the risks of fraud are higher. Even off-line authorization modes exist for special purposes (e.g. airplane on-board shopping) which just collect transactions and seek authorization retroactively. Successful authorization yields an authorization code which the merchant keeps as proof of payment. At end of day, the merchant submits the batch of authorized transactions to his/her bank which settles the claims with the card issuer via the credit card network. Unsubmitted authorizations remain valid for a certain number of days (_"hold"_) before the funds are returned to the cardholder. --- # Debit cards Debit cards are relatively simple (when compared to credit cards). The merchant uses a POS device to read your debit card, which contains your banking coordinates. Your card in combination with your secret key generates an electronic signal for your bank indicating that you are authorizing a transfer of funds. Your bank checks the availability of funds in real time, confirms the transaction and withholds the funds. The transaction is settled via one of the LVPS systems. Debit cards provide substantially less protection from fraud / non-delivery, even though more recent incarnations carry credit card company logos and are endowed with at least some basic protection in order to make them more useful for online transactions. --- class:inverse, middle, center background-image:url("img/giraffe-2233366_1920.jpg") background-size:cover # Looking farther: ## Emerging market retail payment instruments --- # Africa: mobile payments by SMS .left-column[ <br>  .tiny[Image: [Ivan Small](ihttps://commons.wikimedia.org/wiki/File:M-Pesa_service_screen_on_a_feature_phone.jpg ) ] ] .right-column[ Since 2007, mobile payments and banking via SMS has been booming in Afrika. Payment providers like [m-pesa](https://www.safaricom.co.ke/personal/m-pesa) have managed to offer financial services to many unbanked customers who were out of reach for traditional banks. There is controversy about high transaction fees that extract large benefit from mostly poor users. ] --- # China: mobile payments by QR code In the PRC (and now most of Asia), payment by apps that simply scan merchants' QR codes has become extremely popular. The payment app provides a virtual wallet which can be funded by bank funds or credit cards. Execution of payments happens at the provider. The most relevant providers are: * [AliPay](https://intl.alipay.com), and * [WeChat Pay](https://pay.weixin.qq.com/index.php/public/wechatpay). Unlike credit or debit cards, QR payments have little risk of theft of the payer's identity because only the merchant's identity is encoded in the QR code and is transmitted. Reports of criminals replacing a merchant's QR code with a code of their own are now becoming more frequent, though. WeChat is a perfect example how how digital payment services can quickly reach dominant market share if they are unrolled on a pre-existing network with huge user base (the main app has functionality comparable to WhatsApp). I am sure Mark Zuckerberg has been scratching his head about this a lot. --- class:inverse,middle,center #Blockchain: Foundations --- #The peer-to-peer origins of Bitcoin From a technological point of view, blockchains like Bitcoin draw heavily on techniques that already have a long history as cornerstones of peer-to-peer network software. We'll talk about P2P networks today and learn more about the technologies under the hood such that we'll have an easier time next week when it comes to understanding Bitcoin. --- #Internet, under the hood To this day, the most important internet application remains HTTP: your browser connecting to a web page. Under the hood, when you load a page (e.g. http://www.google.com), what happens roughly the following: * Your computer queries DNS for the IP address of the page that y you're loading: `www.google.com->216.58.198.46` * Your computer opens a TCP connection to port 80 (HTTP) or 443 (HTTPS) of the computer at the given IP address, which in the case of HTTP(s) typically is a server. * The server sends data: the requested HTML page is served. * Your computer keeps acknowledging the packages received, and closes the connection. If you want to see this live in action, open your web browser's developer mode, and watch the network tab while a page is loading. --- # The data monopoly of "servers" In the early days of internet (and more again today), internet content was almost exclusively provided by dedicated central computers, typically denoted as "servers": * company webpages * hacker pages * hobbyist pages In other words, if you wanted to distribute any content, you needed to find a way for it to make its way on a server (e.g. rent webspace, or run your own server). The fact that many server-hosted pages (e.g. facebook) now accept the upload of huge amounts of user-generated data doesn't change a bit about this: only the people running servers have the ability to control the distribution of data to recepients. --- # Every computer can be a server! Technologically there is no reason that would dictate this strong asymmetry between internet (client) users and servers: In fact, every computer can run in server mode and respond to internet requests! So can yours: ```python import socket server_address = ('localhost', 10000) sock.bind(server_address) sock = socket.socket(socket.AF_INET, socket.SOCK_STREAM) sock.listen(1) while True: # Wait for a connection connection, client_address = sock.accept() # then do whatever you want to do with the connection #.... connection.close() ``` With code as simple as this, one can serve incoming requests from other machines (in this example, the server listens on port 10000). --- #Peer to peer networking Peer-to-peer networking is a distributed alternative to the predominant heavily centralized content provision model. For a peer-to-peer network, it suffices to run peer-to-peer software which connects to computers of other users that are running the same software. Technologically, this happens in three steps: * **Bootstrap.** The machine attempts to locate "peers", i.e. other machines running the same service, e.g. by querying a known IP address for a list of some known network participants or by attempting at random to "talk" to any address that it can reach. Once a first peer has successfully been reached, the software asks it for a list of further peers. The software connects to a subset of those other peers as well. * **Directory services and request forwarding:** the peer to peer software receives and forwards requests that it receives from other peers. For example, a file sharing software may listen to incoming searches for files, and if it doesn't find those files locally, forward the query to other peers. --- #Peer-to-peer networking (cont.) * **Direct connection:** Having located users who would benefit from a direct connection between each other (e.g. file owner vs. user searching for the file) via the P2P directory, the software creates a direct channel of communication between those users for the transfer of files, telephony voice data or whatever the software's key service may be. Of course, one prominent application of peer-to-peer software has been the illegal distribution of copyrighted information that nobody would want to load on a web server for the fear of legal consequences. This has earned P2P a "dark" reputation even though the technology itself is perfectly clean and legal. The download of copyrighted material is not, of course. --- # Verifying data integrity In peer-to-peer systems, _anything goes_: users have no control over which other computer they connect with, and there is no reason to believe that the other side is trustworthy in any sense. Assume one has received data, how can one verify the integrity of these data? A very costly way would be to download the same data from several other sources as well and compare what was received. A much better way is to use a __cryptographic hash function__: take a function which can be fed arbitrary data as input, and spits out some "fingerprint" of the data: - the same data must give always the same hash, i.e. the function must be fully _deterministic_ - the set of potential input data should be mapped as uniformly as possible to the set of possible hashes - the hashes should be easy to compute and much shorter than the data. --- # Cryptographic hash functions **Properties of a good cryptographic hash function:** - _collision resistance:_ it must be computationally unfeasible to find a pair of data (A, B) such that `\(h(A) = h(B)\)`. - _preimage resistance:_ it must be computationally unfeasible, given hash `\(a\)`, to find a message such that `\(h(m) = a\)`. - _second preimage resistance:_ it must be computationally unfeasible to, given a message `\(m_1\)`, find another message `\(m_2\)` such that `\(h(m_1) = h(m_2)\)`. **Cryptographic hash functions**: How do we know that some complicated function is a good cryptographic hash function? Answer: we never know! Many hashing algorithms that were believed to be good have been broken, e.g. MD4, MD5. At the moment, SHA256 still seems good for all we know. --- # Cryptographic hash functions: examples Cryptographic hash functions are better than the police when it comes to finding small (or big) integrity problems with your data: .small[ ```python import hashlib # prints an MD5 hash def print_with_hash(data): print (data, " | MD5 hash: ", hashlib.md5(data).hexdigest()) print_with_hash(b'The world is big.') print_with_hash(b'The word is big. ') ```] Output: .small[ ```text b'The world is big.' | MD5 hash: fe3c1c076552b3e6c61a2d3d4b288340 b'The word is big. ' | MD5 hash: f78c604d621c6b11436c95c5152b2a3d ``` ] .footnote[*We use the MD5 hash function in all our examples just because it generates nice short hashes. But it's known to be broken, so don't use it in production!] --- # Hash lists In peer-to-peer networks, it's quite typical that some blocks of the same file are provided to you by one peer, other blocks by another. Hence, it's ideal to know a list of the correct hashes of all the data blocks upfront:  That's for example how Bittorrent works. A `.torrent` file contains a list of block hashes, and your torrent software validates incoming data against these hashes. Note that the number of hashes will increase linearly with the number of blocks. The complexity of verifying that a given block belongs to the file is therefore `\(\mathcal O(n)\)`. ??? ```graphviz digraph G { rankdir="BT" node [ fontsize = "14" fontname = "Times-Roman" fontcolor = "black" shape = "box" color = "black" width = "0.5" ]; edge [ fontsize = "14" fontname = "Times-Roman" fontcolor = "black" color = "black" ]; "h01" [ label = "h(01)" shape = "ellipse" kind = "file" ]; "h02" [ label = "h(02)" shape = "ellipse" kind = "file" ]; "h03" [ label = "h(03)" shape = "ellipse" kind = "file" ]; "h04" [ label = "h(04)" shape = "ellipse" kind = "file" ]; "h05" [ label = "h(05)" shape = "ellipse" kind = "file" ]; "h06" [ label = "h(06)" shape = "ellipse" kind = "file" ]; "01" [ label = "Block\n01" pname = "?" kind = "proc" ]; "02" [ label = "Block\n02" pname = "dotty" kind = "proc" ]; "03" [ label = "Block\n03" pname = "dotty" kind = "proc" ]; "04" [ label = "Block\n04" pname = "dotty" kind = "proc" ]; "05" [ label = "Block\n05" pname = "dotty" kind = "proc" ]; "06" [ label = "Block\n06" pname = "dotty" kind = "proc" ]; 01->h01 02->h02 03->h03 04->h04 05->h05 06->h06 } ``` --- # Merkle trees One can do better than linear complexity (and in addition enjoy other important improvements): let's build trees of hashes! The first to describe hash trees was Ralph Merkle (see the original patent [here](https://worldwide.espacenet.com/textdoc?DB=EPODOC&IDX=US4309569)), so they bear his name. The idea is simple: For any pair of hashes, join their hashes together and hash over these hash data again. Do so until you reach one single top node, which is called the Merkle root (see the illustration on the next page). Of course, this works only if there's an even number of nodes at every level below the top one. If there isn't, the convention is to simply duplicate the last node, which occurs in our example to the hash _h(H05, H06)_. If the tree is binary (i.e., every node has two leafs), then a tree of height `\(h\)` has `\(2^h\)` final nodes. Reversing this logic, the tree that belongs to a file of `\(n\)` blocks will have a height of `\(\mathcal O(\log(n))\)`. This will prove a key advantage of Merkle trees when it comes to validation, more about this later. --- #Merkle trees  ??? ```graphviz digraph G { rankdir="BT" node [ fontsize = "14" fontname = "Times-Roman" fontcolor = "black" shape = "box" color = "black" width = "0.5" ]; edge [ fontsize = "14" fontname = "Times-Roman" fontcolor = "black" color = "black" ]; "root" [ label = "h(H1234,H5656)\nMerkle Root" shape = "ellipse" ]; "h14" [ label = "h(H12,H34)" shape = "ellipse" kind = "file" ]; "h58" [ label = "h(H56,H56)" shape = "ellipse" kind = "file" ]; "h12" [ label = "h(H01, H02)" shape = "ellipse" kind = "file" ]; "h12" [ label = "h(H01, H02)" shape = "ellipse" kind = "file" ]; "h34" [ label = "h(H03,H04)" shape = "ellipse" kind = "file" ]; "h56" [ label = "h(H05, H06)" shape = "ellipse" kind = "file" ]; "h01" [ label = "h(01)" shape = "ellipse" kind = "file" ]; "h02" [ label = "h(02)" shape = "ellipse" kind = "file" ]; "h03" [ label = "h(03)" shape = "ellipse" kind = "file" ]; "h04" [ label = "h(04)" shape = "ellipse" kind = "file" ]; "h05" [ label = "h(05)" shape = "ellipse" kind = "file" ]; "h06" [ label = "h(06)" shape = "ellipse" kind = "file" ]; "01" [ label = "Block\n01" pname = "?" kind = "proc" ]; "02" [ label = "Block\n02" pname = "dotty" kind = "proc" ]; "03" [ label = "Block\n03" pname = "dotty" kind = "proc" ]; "04" [ label = "Block\n04" pname = "dotty" kind = "proc" ]; "05" [ label = "Block\n05" pname = "dotty" kind = "proc" ]; "06" [ label = "Block\n06" pname = "dotty" kind = "proc" ]; 01->h01 02->h02 03->h03 04->h04 05->h05 06->h06 h01->h12 h02->h12 h03->h34 h04->h34 h05->h56 h06->h56 h12->h14 h34->h14 h56->h58 h56->h58 h14->root h58->root } ``` --- # Merkle trees and Merkle proof Merkle trees have some really nice properties: * Change even a bit in the file, and the Merkle root will change! In that sense it works just as good as a regular hash over the entire file. * Given the Merkle root of a file, it is very inexpensive to verify (_"Merkle proof"_) whether a given piece of data is a valid data block in the file: - In the example on the previous page, assume that you know the file's Merkle root from a trusted source. You've just received block 03 but don't know any of the other blocks. How much data do you need, and does it have to come from a trusted source, to have __proof__ that the block which you received is genuine and an element of the file? - You only need three more hashes, and _don't_ need to trust the one who is providing them to you (fakes won't yield the right root)! - I illustrate this on the next page. The orange hashes are those you need. You can then calculate the green hashes and compare the resulting root against the true one. * This is a more general principle: knowing the Merkle root, it takes just `\(\mathcal O(\log(n))\)` steps (proportional to the height of the tree rather than to the size of the file) to verify that a specific block indeed belongs to any file. This is way superior to `\(\mathcal O(n)\)`! --- # Merkle proof  ??? ```graphviz digraph G { rankdir="BT" node [ fontsize = "14" fontname = "Times-Roman" fontcolor = "black" shape = "box" color = "black" width = "0.5" ]; edge [ fontsize = "14" fontname = "Times-Roman" fontcolor = "black" color = "black" ]; "root" [ label = "h(H1234,H5656)\nMerkle Root" shape = "ellipse" style = "filled" fillcolor = "green" kind = "file" ]; "h14" [ label = "h(H12,H34)" shape = "ellipse" style = "filled" fillcolor = "green" kind = "file" ]; "h58" [ label = "h(H56,H56)" shape = "ellipse" style = "filled" fillcolor = "orange" kind = "file" ]; "h12" [ label = "h(H01, H02)" shape = "ellipse" style = "filled" fillcolor = "orange" kind = "file" ]; "h12" [ label = "h(H01, H02)" shape = "ellipse" kind = "file" ]; "h34" [ label = "h(H03,H04)" shape = "ellipse" style = "filled" fillcolor = "green" kind = "file" ]; "h56" [ label = "h(H05, H06)" shape = "ellipse" kind = "file" ]; "h01" [ label = "h(01)" shape = "ellipse" kind = "file" ]; "h02" [ label = "h(02)" shape = "ellipse" kind = "file" ]; "h03" [ label = "h(03)" shape = "ellipse" style = "filled" fillcolor = "green" kind = "file" ]; "h04" [ label = "h(04)" shape = "ellipse" style = "filled" fillcolor = "orange" kind = "file" ]; "h05" [ label = "h(05)" shape = "ellipse" kind = "file" ]; "h06" [ label = "h(06)" shape = "ellipse" kind = "file" ]; "01" [ label = "Block\n01" pname = "?" kind = "proc" ]; "02" [ label = "Block\n02" pname = "dotty" kind = "proc" ]; "03" [ label = "Block\n03" pname = "dotty" style = "filled" fillcolor = "red" kind = "proc" ]; "04" [ label = "Block\n04" pname = "dotty" kind = "proc" ]; "05" [ label = "Block\n05" pname = "dotty" kind = "proc" ]; "06" [ label = "Block\n06" pname = "dotty" kind = "proc" ]; 01->h01 02->h02 03->h03 04->h04 05->h05 06->h06 h01->h12 h02->h12 h03->h34 h04->h34 h05->h56 h06->h56 h12->h14 h34->h14 h56->h58 h56->h58 h14->root h58->root } ``` --- # Merkle roots in the Blockchains Next week we'll read the original Satoshi Nakamoto Bitcoin white paper. Among other things, we'll learn how Merkle trees are used exactly in Bitcoin. They're of crucial importance because they enable the efficient verification of a single payment record in a sea of data without having to download all the other payments. To prove that a payment has actually happened, it suffices to have the transaction in question and obtain from the network the (few) hashes for completing the Merkle proof all the way up to the trusted Merkle root. In next week's lab we also calculate a simple Merkle tree. Stay tuned! --- class: center, middle # Thanks! More material on [https://silviopetriconi.github.io](https://silviopetriconi.github.io). For questions, comments and suggestions regarding these slides please contact the author, [`silvio.petriconi@unibocconi.it`](mailto:silvio.petriconi@unibocconi.it). <br></br> [](http://creativecommons.org/licenses/by-nc-sa/4.0/) <br></br> This work is licensed under a [Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License](http://creativecommons.org/licenses/by-nc-sa/4.0/).